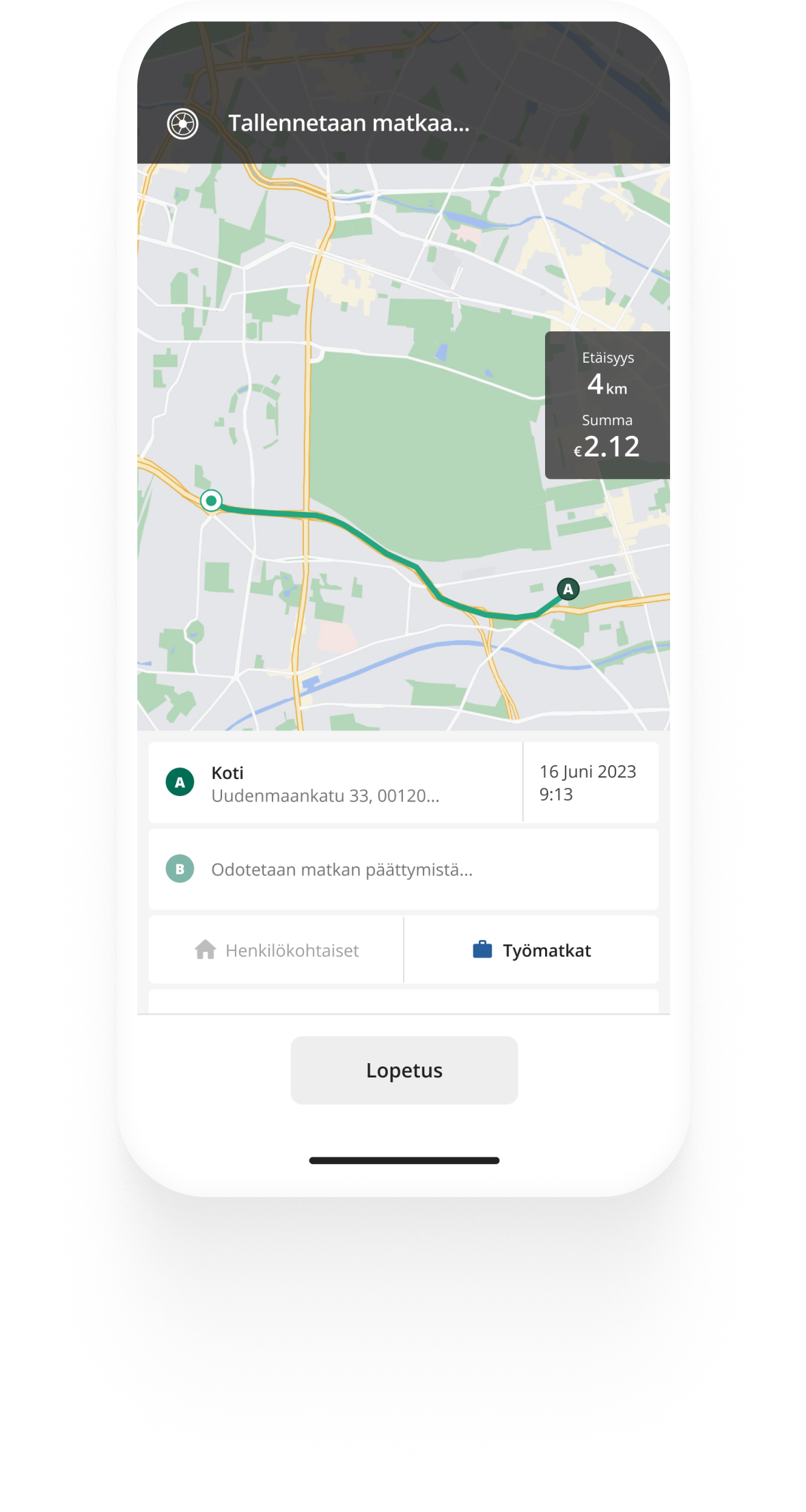

Automaattinen seuranta

Seuraa matkoja taskustasi

Kun seuraat ajokilometrejä automaattisesti Driversnoten avulla, voit kirjata matkoja avaamatta edes sovellusta. Liiketunnistus seuraa matkoja automaattisesti – riittää, että lähdet ajamaan. Jos unohdat seurata matkoja, voit lisätä ne myöhemmin manuaalisesti.

Lue lisää Rekisteröidy

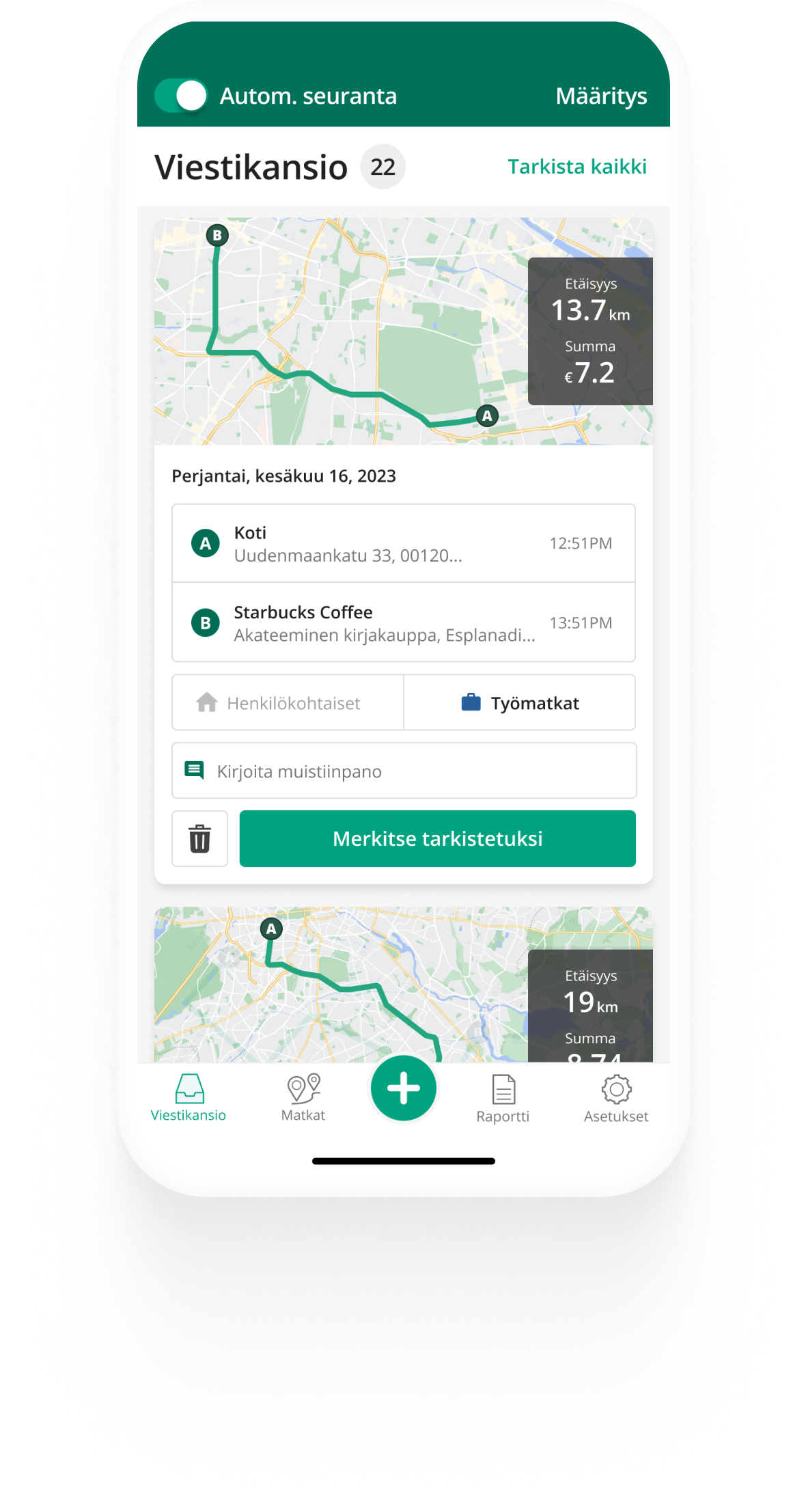

Luokittele

Pidä ajopäiväkirja ajan tasalla

Tarkista ja hyväksy matkasi Driversnotessa. Saat kattavan yhteenvedon, voit hallita ja luokitella matkoja työ- tai yksityismatkoiksi sekä lisätä muistiinpanoja – sovelluksessa tai työpöydällä.

Lue lisää Rekisteröidy

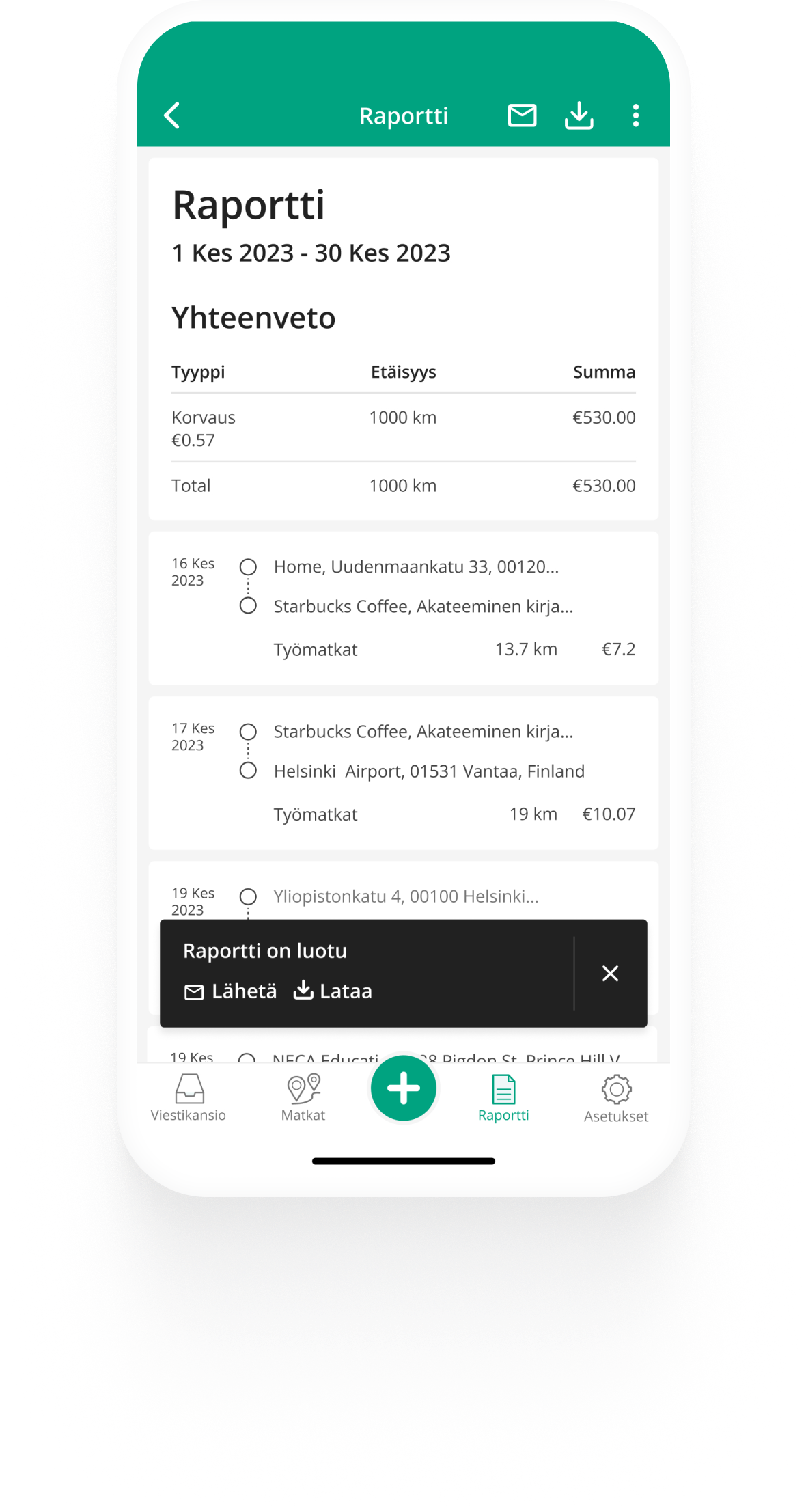

Raportoi

Helpoin tapa noudattaa verolainsäädäntöä

Lataa verolainsäädännön mukaisia ajokilometriraportteja milloin tahansa PDF- ja Excel-muodossa. Olemme tehneet paikallisten veroviranomaisten vaatimusten noudattamisesta helppoa, ja voit mukauttaa raportteja vastaavasti.

Lue lisää RekisteröidyOminaisuudet, jotka tekevät ajokilometrien seurannasta vaivatonta

Sijaintien luominen

Kun tallennat usein käyttämäsi osoitteet, saat matkat kirjattua nopeammin.

Useita ajoneuvoja

Seuraa ajokilometrejä ja pidä erillisiä lokeja useille ajoneuvoille.

Useita työpaikkoja

Seuraa ajokilometrejä ja pidä erillisiä lokeja useille työpaikoille.

Työaika

Aseta työaikasi ja anna sovelluksen luokitella matkasi automaattisesti.

Raportointimuistutukset

Lähetä ajopäiväkirjaraportit aina ajallaan. Me muistutamme sinua.

Mukautettavat kilometrikorvaukset

Mukauta ajopäiväkirjaa lisäämällä siihen omat kilometrikorvauksesi.

Matkamittarin lukemat

Lisää matkamittarin lukemat, niin saat muistutuksia ajopäiväkirjan täydentämisestä.

Seuraa matkoja manuaalisesti

Kirjaa matkat manuaalisesti ja me laskemme sinulle etäisyydet.

Tiimien hallinta

Tarkista ja hyväksy organisaatiosi kilometrikorvaushakemukset helposti. Ota yhteyttä ja kysy lisää.

Työaika

Aseta työaikasi ja anna sovelluksen luokitella matkasi automaattisesti.

Raportointimuistutukset

Lähetä ajopäiväkirjaraportit aina ajallaan. Me muistutamme sinua.

Mukautettavat kilometrikorvaukset

Mukauta ajopäiväkirjaa lisäämällä siihen omat kilometrikorvauksesi.

Matkamittarin lukemat

Lisää matkamittarin lukemat, niin saat muistutuksia ajopäiväkirjan täydentämisestä.

Seuraa matkoja manuaalisesti

Kirjaa matkat manuaalisesti ja me laskemme sinulle etäisyydet.

Tiimien hallinta

Tarkista ja hyväksy organisaatiosi kilometrikorvaushakemukset helposti. Ota yhteyttä ja kysy lisää.

Aloita ilmaiseksi

Yksikään matka ei jää kirjaamatta

Me hoidamme homman, sinun on helppo päästä alkuun ja sitäkin helpompi jatkaa.

Usein kysytyt kysymykset

Toki! Puhelimen ajokilometrien seurantasovellus säästää aikaa, jonka joutuisit muuten käyttämään jokaisen tekemäsi matkan syöttämiseen käsin. Ajokilometrien seurantasovellus kirjaa kaikki kilometrikorvauspyyntöön tarvittavat tiedot reaaliajassa, joten sinulla on kaikki Verohallinnon vaatimat tiedot kilometrikorvauksia tai verovähennyksiä varten.

Driversnoten ajokilometrien seurantasovellus takaa sen, että kaikki työssään ajavat työntekijät seuraavat ajokilometrejään oikein ja pystyvät toimittamaan tarkat raportit ajokilometreistä. Driversnoten kaltainen ajokilometrien seurantasovellus yksinkertaistaa kilometrikorvausten prosessia ja poistaa useita tunteja paperitöitä.

Jos sinulla on esimerkiksi keskimäärin 1 000 kilometriä työajoa kuukaudessa, sinulle kertyy vuodessa 6 360 euroa verovapaata kilometrikorvausta (vuoden 2023 verovapaa kilometrikorvaus on 0,53 €). Ajopäiväkirjasovellus ei kuitenkaan säästä vain rahaa vaan myös aikaa, sillä se kirjaa matkat automaattisesti eikä sinun tarvitse käyttää joka viikko tunteja ajopäiväkirjan manuaaliseen päivittämiseen.